Just Elementary, Inc. » Entries tagged with "Taxes"

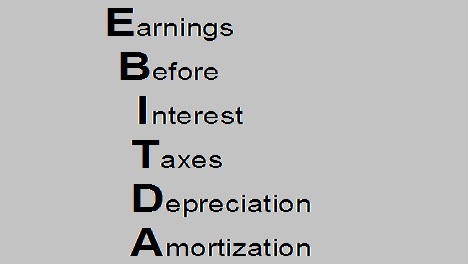

Definition of EBITDA

EBITDA is a common accounting term that is used with sophisticated small businesses, it stands for Earnings Before Interest, Taxes, Depreciation and Amortization. EBITDA is basically the actual cash flow profit of the business based on the actual expenses of the business. There are two categories of items in EBITDA, one category is Taxes, which covers three of the items, amortization, depreciation and taxes themselves. Debt service expense is the other category, which covers the interest on … Read entire article »

Filed under: Business Tips

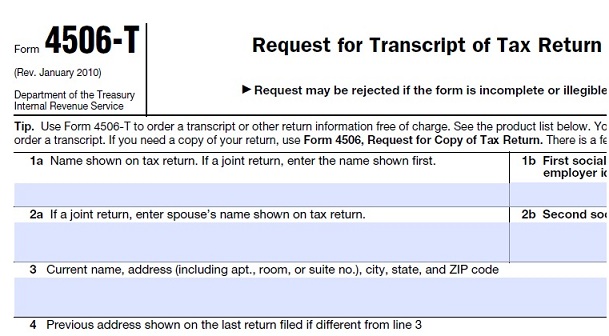

Small Business Due Diligence – Verifying Seller’s Tax Returns via IRS 4506

When trying to buy a small business, it is important to do your Due Diligence to gauge the suitability of the business to your needs, and to make you are paying the appropriate price for the business. One important step is to verify the tax returns that have been filed by the owner of the business. Of course, if the seller hands you copies of the Tax Returns, should you just automatically assume that they … Read entire article »

Filed under: Business Tips, Due Diligence